ITR Filing If You Invest in US Stocks from India: Step 7 In the Dashboard, section click on File Now. We have prepared step-by-step guidelines to assist you in filing Income Tax:→ ITR Filing If You Invest in US Stocks from India: Step 1

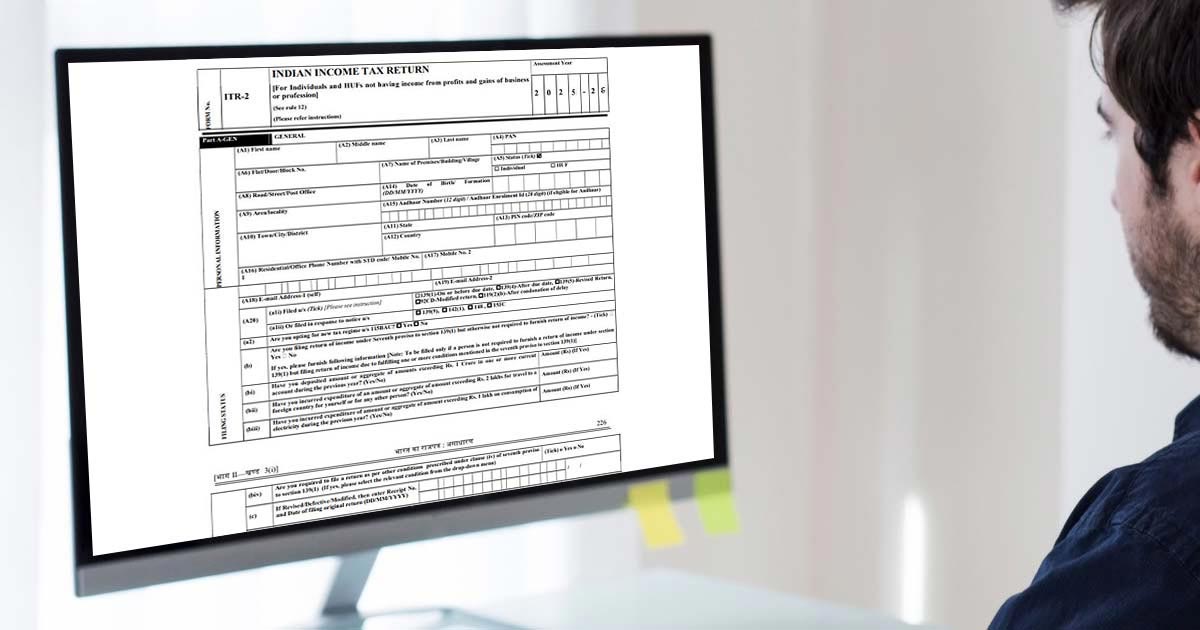

How to file Income Tax Return if you invest in US stocks & ETFs from India? If I have some us stocks gains/losses but my income is less than the taxable limit, shall I still file ITR? - Yes, if you have any foreign source income, ITR filing is compulsory.If I hold us stocks and don’t have any capital gains do I still need to file ITR and report my holdings in the FA schedule? - Yes.FA schedule was prepared for up to Dec 31, 2021, so people who have transactions in 2022, do they not need to file details of us stocks in ITR in this Indian FY? - Yes, they do not need to disclose transactions of Jan-Mar 2022.People only having dividend or interest income and not gains or losses, do they still need to file ITR2 or ITR1 can be filed in this case? - Since they hold foreign assets, ITR 2 is only applicable.Do we need to consider the 1st April to 31st march period for gains/loss/dividends/interest reporting or US financial year should be considered (if yes, details of the financial year)? - Yes, from 01 April to 31 March only.Some important resources before starting to file the income tax →Ĭlick to Read: How are your US stocks and ETF investments taxed? All You Need to Know Some important FAQs before starting to file the income tax →

0 kommentar(er)

0 kommentar(er)